Your donations help someone find a job, strengthen your community and preserve the planet.

Your donations help people who are unemployed or under-employed gain new skills and find jobs they can grow in. You’re also helping preserve the planet by ensuring more items stay in circulation longer.

When you donate your new and gently used items, local Goodwill organizations sell them in stores and online generating revenue to support our nonprofit mission of providing valuable employment training and job placement services for people facing difficulty finding employment in your community.

Find a Donation Center Near You!

Donation Items

Goodwill accepts a wide range of donation items to support our mission of empowering individuals in need. Your generosity can significantly impact others’ lives.

When it comes to donation items, Goodwill understands that every little bit counts. Whether you have used clothing, household items, electronics or furniture that you no longer need, we gratefully accept them all.

Accepted Donation Items

Here are the types of items we accept:

- Clothing and Accessories: We accept used clothing and accessories for men, women and children. This includes formal wear, everyday clothing, shoes, handbags and jewelry, providing more affordable options for those in our communities and supporting our nonprofit initiatives. If you’re looking to donate clothes, Goodwill is your go-to place.

- Household Goods: Donating household goods can help families furnish their homes or find essential items. We accept kitchenware, small appliances, bedding, furniture, home decor and more, allowing individuals and families to create a comfortable living environment.

- Electronics: We accept various electronics, including computers, laptops, tablets, smartphones, televisions and audio equipment. Donating your used electronics gives others access to technology they might not afford otherwise.

Why Donate to Goodwill?

By donating to Goodwill, you are not only decluttering your home but also making a positive difference in someone else’s life. Your contribution helps us provide job training, employment placement services and community-based programs that enhance the lives of countless individuals and families in need. Your donations go directly towards our programs and services, helping us create opportunities and empower individuals to achieve their full potential.

THE DONATION PROCESS

Ready to donate? Just follow these three steps.

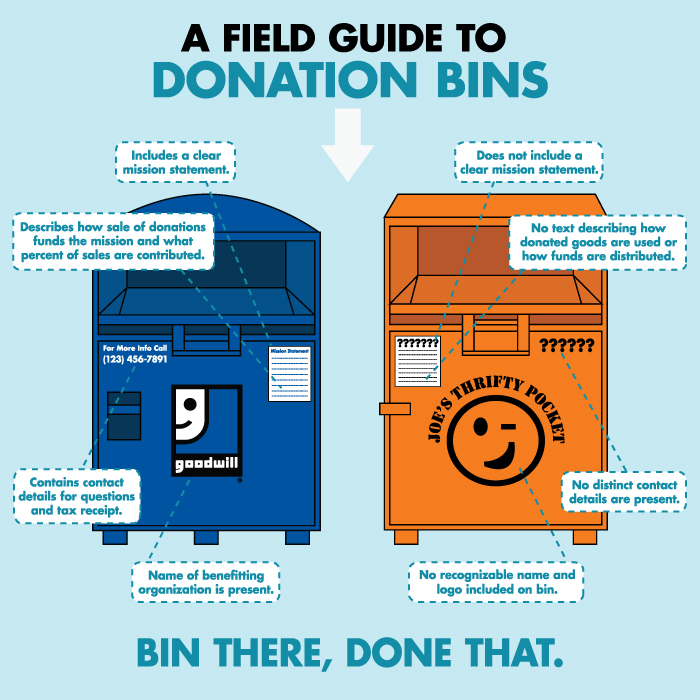

A WORD OF WARNING REGARDING DONATION BINS

Generally, we recommend donating at donation centers staffed by attendants. In many cases, the items collected in bins often support for-profit groups, rather than aiding nonprofit, charitable organizations. To help you make informed donation decisions, we offer the following handy guide.

TAXES AND YOUR DONATIONS

In December 2017, the United States Congress passed a new tax bill into law. While the new law did not affect returns for businesses or individuals for the 2017 tax year, it does change a number of tax provisions for 2018. Primarily, the new tax law practically doubles the standard tax deduction for most filers, which will make it a more attractive option to more Americans. The law does not change the fact that donors continue to be responsible for valuing their donations and that they may be able to deduct the value of those donations if they choose to itemize on their taxes. For any advice regarding the preparation of your taxes, please consult a reputable tax advisor.

Donating to local Goodwill organizations has, and continues to be, a way for people to help others in their community. Goodwill uses the revenue from donated items to create employment placement and job training to contribute to our mission. Last year, Goodwill organizations received more than 107 million donations throughout the U.S. and Canada. Approximately 81% of the Goodwill network’s collective revenue from the sale of donated goods directly supports Goodwill’s nonprofit mission to provide and grow community-based programs and services.

When you drop off your donations at Goodwill, you’ll receive a receipt from a donation attendant. Hang on to this receipt. At the end of the year, if you itemize deductions on your taxes, you can claim a tax deduction for clothing and household items that are in good condition.

The U.S. Internal Revenue Service requires you to value your donation when filing your return. To get started, download our donation valuation guide, which features estimates for the most commonly donated items.