Your donations help someone find a job, strengthen your community and preserve the planet.

When you donate your new and gently used items, local Goodwill organizations sell them in stores and online generating revenue to provide valuable employment training and job placement services for people in your community.

Looking for the nearest Goodwill? Use our locator to find the nearest career center (for help finding a job), retail store, donation site, or outlet store (which sells items in bulk) operated by our network of more than 150 independent, community-based Goodwills.

Find a Donation Center Near You!

THE DONATION PROCESS

Ready to donate? Just follow these three steps.

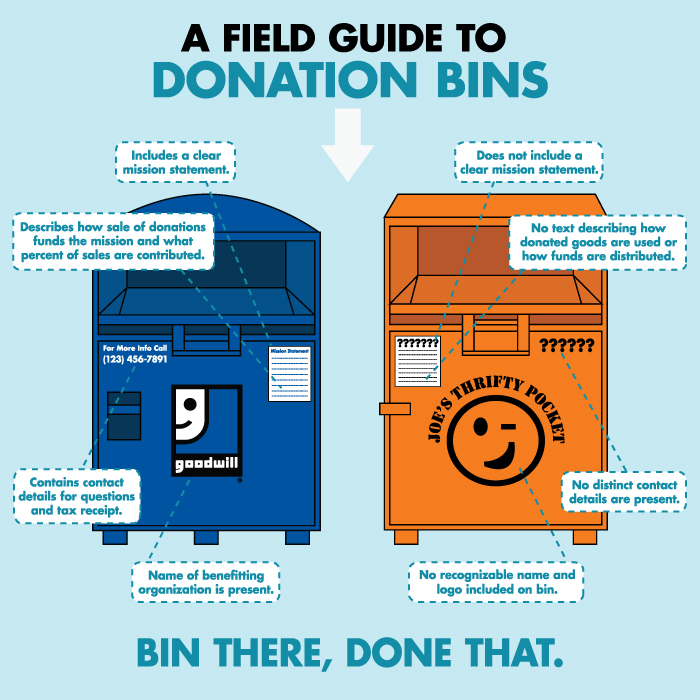

A WORD OF WARNING REGARDING DONATION BINS

Generally, we recommend donating at donation centers staffed by attendants. In many cases, the items collected in bins often support for-profit groups, rather than aiding nonprofit, charitable organizations. To help you make informed donation decisions, we offer the following handy guide.

TAXES AND YOUR DONATIONS

In December 2017, the United States Congress passed a new tax bill into law. While the new law did not affect returns for businesses or individuals for the 2017 tax year, it does change a number of tax provisions for 2018. Primarily, the new tax law practically doubles the standard tax deduction for most filers, which will make it a more attractive option to more Americans. The law does not change the fact that donors continue to be responsible for valuing their donations and that they may be able to deduct the value of those donations if they choose to itemize on their taxes. For any advice regarding the preparation of your taxes, please consult a reputable tax advisor.

Donating to local Goodwill organizations has, and continues to be, a way for people to help others in their community. Goodwill uses the revenue from donated items to create employment placement and job training to contribute to our mission. Last year, Goodwill organizations received more than 107 million donations throughout the U.S. and Canada. Approximately 81% of the Goodwill network’s collective revenue from the sale of donated goods directly supports Goodwill’s nonprofit mission to provide and grow community-based programs and services.

When you drop off your donations at Goodwill, you’ll receive a receipt from a donation attendant. Hang on to this receipt. At the end of the year, if you itemize deductions on your taxes, you can claim a tax deduction for clothing and household items that are in good condition.

The U.S. Internal Revenue Service requires you to value your donation when filing your return. To get started, download our donation valuation guide, which features estimates for the most commonly donated items.